This is the tenth in a weekly series of posts exploring themes raised in Dambisa Moyo’s book Dead Aid. In chapter 9 of the book, Moyo cites with approval a number of different micro-lending schemes, including the Nobel Peace Prize-winning Grameen Bank, which has found that it is possible to run a commercially successful business by lending small amounts of capital to people with no collateral, thereby helping them to work their way out of poverty.

This is the tenth in a weekly series of posts exploring themes raised in Dambisa Moyo’s book Dead Aid. In chapter 9 of the book, Moyo cites with approval a number of different micro-lending schemes, including the Nobel Peace Prize-winning Grameen Bank, which has found that it is possible to run a commercially successful business by lending small amounts of capital to people with no collateral, thereby helping them to work their way out of poverty.

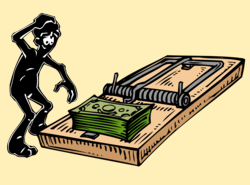

There is quite a body of literature on microfinance schemes and techniques, and I studied widely before attempting, with some friends, an experiment in microfinance in Nairobi. Whereas successful micro-lending projects claim default rates of a few percent or less, ours was significantly higher. Some recipients simply took the money and disappeared. Most did their best to repay the money, but after a few months suffered some sort of calamity which wiped out their ability to repay.

We found and interviewed most of the people who failed to repay their loans (other than those who simply disappeared with the money), and their reasons for failure to repay seemed genuine. It seems self-evident that microfinance is only useful in situations where the loan recipient will have a net positive income after receiving the loan, taking into account the security of the local environment and the likelihood of expensive calamities. Micro-loans are of no assistance to people living in the worst circumstances.